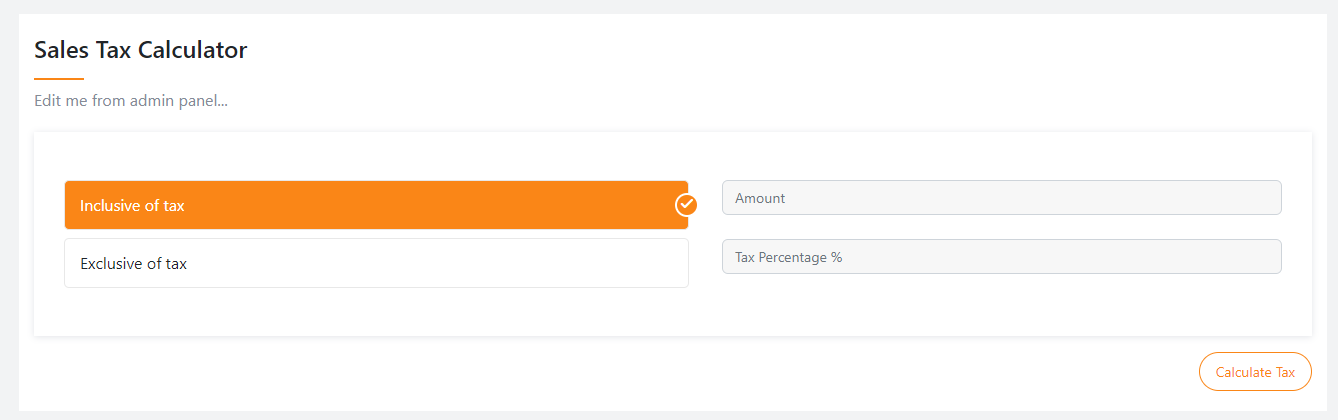

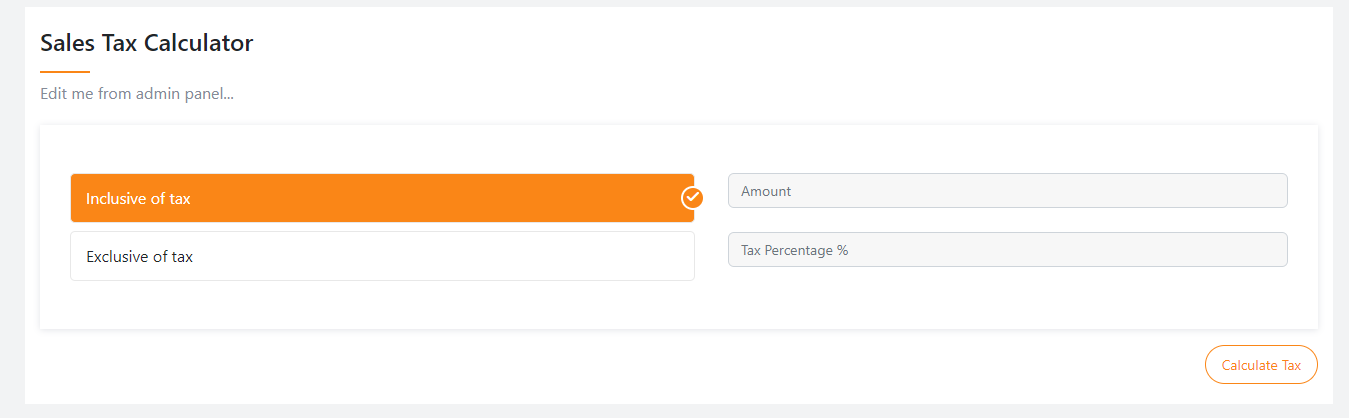

Sales Tax Calculator

A Sales Tax Calculator Tool helps you quickly determine the sales tax for a purchase. Enter the amount and tax rate to get the result.

Result

| Net Amount | ||

|---|---|---|

| Tax Rate | ||

| Gross Amount |

Share on Social Media:

A Sales Tax Calculator Tool helps you quickly determine the sales tax for a purchase. Enter the amount and tax rate to get the result.

Sales Tax Calculator Tools are essential for both consumers and businesses. They simplify the process of calculating sales tax on purchases. Understanding the exact amount of tax ensures you comply with local and state tax laws. These tools save time and reduce errors, making financial management easier.

Whether you're shopping or running a business, knowing the sales tax helps manage budgets effectively. Online calculators are user-friendly and accessible, ensuring accurate results in seconds. By using these tools, you gain confidence in your financial transactions. Stay informed and accurate with a reliable Sales Tax Calculator Tool.

Introduction To Sales Tax

Introduction to Sales Tax

Sales tax is a crucial aspect of everyday transactions. This tax impacts both consumers and businesses. Understanding sales tax can help you manage finances better.

What Is Sales Tax?

Sales tax is a tax levied on the sale of goods and services. It is usually a percentage of the sale price. The seller collects this tax from the buyer and then pays it to the government.

Different regions may have different sales tax rates. These rates can vary based on the type of goods or services. Knowing the sales tax rate in your area is essential.

Importance Of Sales Tax

Sales tax is important for several reasons. It generates revenue for the government. This revenue is used for public services like roads and schools.

Sales tax also helps regulate the economy. It can influence consumer behavior. Higher sales taxes may discourage excessive spending. Lower sales taxes can boost spending.

Here's a quick overview of sales tax:

| Aspect | Description |

|---|---|

| Definition | Tax on sale of goods and services |

| Collection | Collected by seller, paid to government |

| Variation | Rates vary by region and product type |

| Use | Funds public services and infrastructure |

Challenges In Sales Tax Calculation

Calculating sales tax can be a tough task. This is especially true for businesses. Mistakes can lead to issues. It is also very time-consuming. Understanding the challenges helps in finding solutions.

Common Errors

Errors in sales tax calculation are quite common. These mistakes include:

- Incorrect tax rates

- Wrong jurisdiction

- Missing tax exemptions

These errors can cause financial losses. They can also lead to penalties. Ensuring accurate calculations is crucial.

Time-consuming Process

Calculating sales tax takes a lot of time. Businesses have to:

- Identify the correct tax rate

- Apply the tax rate to each item

- Verify tax exemptions

- File tax returns

This process can be very tiring. It also takes away time from other important tasks. Using a sales tax calculator tool can save time.

What Is A Sales Tax Calculator?

A Sales Tax Calculator helps you quickly compute the sales tax on items. It is a handy tool for buyers and sellers. The tool simplifies the process of calculating taxes.

Definition

A Sales Tax Calculator is an online tool. It calculates the tax on a purchase. Input the price and tax rate. The tool will show the total price, including the tax.

Key Features

- Easy to Use: Enter the price and tax rate. The calculator shows the result instantly.

- Accurate Calculations: The tool ensures precise tax amounts. Avoid errors when calculating manually.

- Time-Saving: Quickly compute taxes without complicated math.

- Multiple Currencies: Some calculators support different currencies. This is useful for international purchases.

- Custom Tax Rates: Enter specific tax rates for your region. This makes the tool versatile.

- Breakdown of Costs: See the price before tax, tax amount, and total cost.

Here is a sample table to illustrate the use of a Sales Tax Calculator:

| Item Price | Tax Rate | Tax Amount | Total Price |

|---|---|---|---|

| $100 | 7% | $7 | $107 |

| $50 | 5% | $2.50 | $52.50 |

Benefits Of Using A Sales Tax Calculator

Benefits of Using a Sales Tax Calculator

Using a Sales Tax Calculator offers many advantages. It helps with precise tax calculations and saves valuable time. Below are some key benefits:

Accuracy

A Sales Tax Calculator ensures high accuracy in calculations. Manual calculations can lead to mistakes. The tool eliminates errors by automating the process.

Accurate tax calculations are crucial for businesses. They prevent overpaying or underpaying taxes. This accuracy helps in maintaining correct financial records.

Time Efficiency

The Sales Tax Calculator saves a lot of time. Manual calculations are time-consuming and tedious. The tool speeds up the process significantly.

With this tool, you can focus on other important tasks. It increases productivity and reduces stress related to tax calculations.

How To Use A Sales Tax Calculator

Understanding how to use a Sales Tax Calculator can save you time and money. This tool helps you quickly calculate the sales tax on your purchases.

Step-by-step Guide

- Enter the Amount: Type the total amount of your purchase.

- Select Your State: Choose the state where you made the purchase.

- Click Calculate: Press the calculate button to see the sales tax.

- Review Results: Check the total amount including sales tax.

Best Practices

- Double-Check the Amount: Make sure you enter the correct purchase amount.

- Know Your State's Tax Rate: Tax rates vary by state, so be aware.

- Use Updated Tools: Ensure the calculator uses current tax rates.

- Save Your Calculations: Keep a record for future reference.

Choosing The Right Sales Tax Calculator

Finding the perfect sales tax calculator can save time and money. It's essential to pick one that suits your needs and offers accurate results. Let's explore some key factors to consider and the top tools available in the market.

Factors To Consider

When selecting a sales tax calculator, keep these factors in mind:

- Accuracy: The tool must provide precise tax calculations.

- User Interface: Look for an easy-to-use interface.

- Integration: Ensure it integrates with your existing systems.

- Support: Check if there is customer support available.

- Cost: Compare the pricing plans and choose one that fits your budget.

Top Tools In The Market

Here are some of the best sales tax calculators you can consider:

| Tool | Features | Pricing |

|---|---|---|

| TaxJar |

| Starts at $19/month |

| Avalara |

| Custom pricing |

| QuickBooks Sales Tax |

| Included with QuickBooks subscription |

By considering these factors and exploring top tools, you can find the right sales tax calculator to meet your needs.

Case Studies

Our Sales Tax Calculator Tool has made a big impact. It helps both small businesses and large corporations. Below, we share some success stories.

Small Business Success Stories

Small businesses often face challenges calculating sales tax. Our tool has provided a solution for many. Here are some stories:

| Business Name | Industry | Results |

|---|---|---|

| Jane's Boutique | Retail |

|

| Mike's Cafe | Food & Beverage |

|

Large Corporations

Large corporations also benefit from our tool. They handle bigger volumes and complex tax rules. Let's look at some examples:

| Corporation Name | Industry | Results |

|---|---|---|

| Tech Innovators Inc. | Technology |

|

| Global Goods Ltd. | Wholesale |

|

Future Of Sales Tax Calculators

The future of sales tax calculators is bright and promising. With technology evolving, these tools are set to become more efficient and user-friendly. This will help businesses save time and reduce errors. Let's explore the key advancements shaping the future of sales tax calculators.

Technological Advancements

Technological advancements are transforming sales tax calculators. Artificial Intelligence (AI) and Machine Learning (ML) play a significant role. They help automate complex calculations, making them faster and more accurate. This reduces manual effort and minimizes the risk of errors.

Another significant advancement is the use of cloud computing. Cloud-based calculators offer real-time updates and access from anywhere. This makes it easier for businesses to stay compliant with changing tax laws. Blockchain technology also enhances transparency and security in tax calculations.

Integration With Other Systems

Modern sales tax calculators integrate seamlessly with other systems. This includes accounting software, e-commerce platforms, and ERP systems. This integration ensures that data flows smoothly between different platforms. It reduces the need for manual data entry and minimizes errors.

Integration with accounting software helps in accurate financial reporting. It ensures that tax calculations are consistent with financial records. E-commerce platform integration enables automatic tax calculation during checkout. This improves the customer experience and ensures compliance.

ERP system integration ensures that tax calculations are aligned with overall business operations. This makes it easier for businesses to manage their finances and stay compliant with tax laws.

Frequently Asked Questions

What Is A Sales Tax Calculator?

A sales tax calculator is a tool that computes the sales tax. It helps you quickly determine the total cost, including tax, for any purchase.

How Do You Use A Sales Tax Calculator?

Enter the item's price and the sales tax rate. The calculator will then display the tax amount and total cost.

Why Is A Sales Tax Calculator Important?

A sales tax calculator simplifies complex tax calculations. It ensures accuracy, saves time, and helps in financial planning by providing exact totals.

Can A Sales Tax Calculator Handle Different Tax Rates?

Yes, a sales tax calculator can handle multiple tax rates. You can input different rates to see how they affect the total cost.

Conclusion

Using a sales tax calculator tool simplifies tax calculations. It saves time and reduces errors. This tool is essential for businesses and individuals alike. Make your tax process easier and more accurate. Try the sales tax calculator today and experience the benefits.